B300 Reporting Module for Sage X3

Licensed cultivators, producers or packagers of cannabis products in Canada are required to timely submit Form B300, Cannabis Duty and Information Return, to the Canada Revenue Agency on a monthly basis.

Form B300 is a complex and detailed reporting requirement for movements of unpackaged and packaged cannabis inventory, and the total sales and payable duties.

COMPLIANCE

B300 Module for

Sage X3

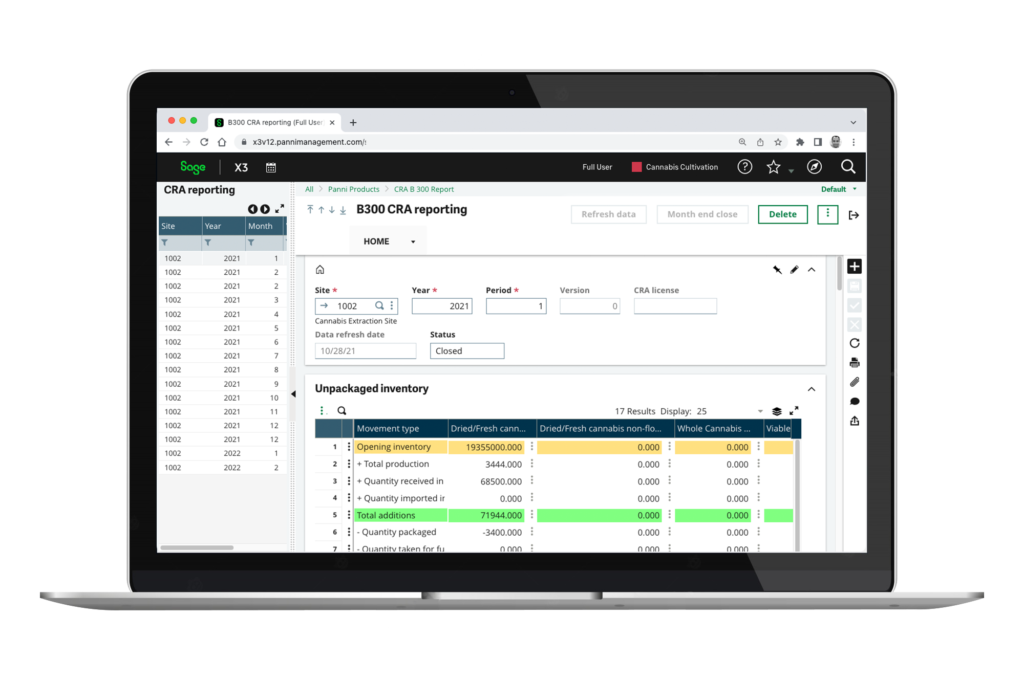

B300 module leverages the power of Sage X3 and seamlessly automates month-end reporting requirements for the CRA. All reports are managed by period.

B300 Reporting Solution Capabilities

- Automates reporting requirements.

- Greatly reduces man-hours required for regulatory compliance.

- Automatically pulls in data for the report.

- Manages reports by period.

- Reports are created and locked for each period.

- Reports are available for auditing.

B300 module for Sage X3 is available as

Pre-built into Sage X3 for new Cannabis ERP deployments

Add-on for existing Sage X3 deployments

Read our Customer's Success Story

One of the Top Vertically Integrated Canadian Cannabis Company Stays Compliant with Sage X3 and Panni’s CTLS and B300 Reporting Modules

The company was looking to implement a complete end-to-end ERP system that could not only help them ramp up but also meet regulatory requirements of the Cannabis industry like the CTLS (Health Canada) and Form B300 (Canada Revenue Agency) monthly reportings.

The company can now calculate the excise tax requirement for the Form B300 for the Canada Revenue Agency while staying compliant with Health Canada’s CTLS reporting all with a few clicks, saving hundreds of man-hours every month.

Watch the B300 Module Webcast

Webcast: B300 Module for Sage X3

Watch our webcast and demo of the B300 module for Sage X3 and how easy it is to complete month end reporting for Canada Revenue Agency.

Watch the product webcast

What our Customers Say

Gordana Volkanoska

Director, Quality Assurance

Canadian Clinical Cannabinoids Inc.

Other solutions essential for your processing and manufacturing business

CTLS reporting module for Sage X3

Integrated with Sage X3, report to Health Canada with a few clicks

Frequently Asked Questions

How is the Panni B300 Module licensed?

It is licensed by the number of cannabis facilities for which Form B300 has to be reported. So, if you have two facilities extracting cannabis, you will require two licenses.

How quickly can the B300 module be deployed?

The B300 Module is included in new deployments. For existing Sage X3 deployments, the module can be deployed and you can being reporting, all within a few hours.

Can I deploy Panni's B300 solution after going live with Sage X3?

Correct – you can deploy the solution at any time. It will can also provide reporting for the months prior to deploying the B300 module.

What sort of support is available with Panni's CTLS module on an ongoing basis?

Panni provides continuous support for each month filing with CRA. If your business process changes and your company requires additional configuration or customization, it is covered in the licensing fee.

Can the module automatically calculate excise duty for packaged finished goods based on THC percentage in the bulk finished goods?

Yes, it does.

Is the B300 module compliant with EDN55 and EDN60 (Excise Duty Notices)?

Yes, it is compliant with both EDN55 and EDN60. The module will be updated for every relevant future notice.

Is your cannabis business in need of a robust reporting solution?

Contact us and to get B300 Module for you business today.